Ask most people you know, and they might never have heard some of the strange insurance policies we have on this list. People are aware of health and motor insurance policies, but how about the ones that seem like there are no reasons they should exist? Let’s run down our top list of unusual insurance policies.

Body Parts Insurance

Body parts insurance policy is a strange insurance policy that covers an insured in the event of loss of the specific body part insured. Although premiums can be worth millions of dollars, according to a report, 46% of survey respondents said they would buy insurance for any three of these body parts; their heart, legs and eyes.

Insurance for the heart, legs, and eyes might make sense to you, but how bizarre is an insurance policy for your taste buds? Examples include food critic and restaurateur Egon Ronay who insured his taste buds for £250,000.

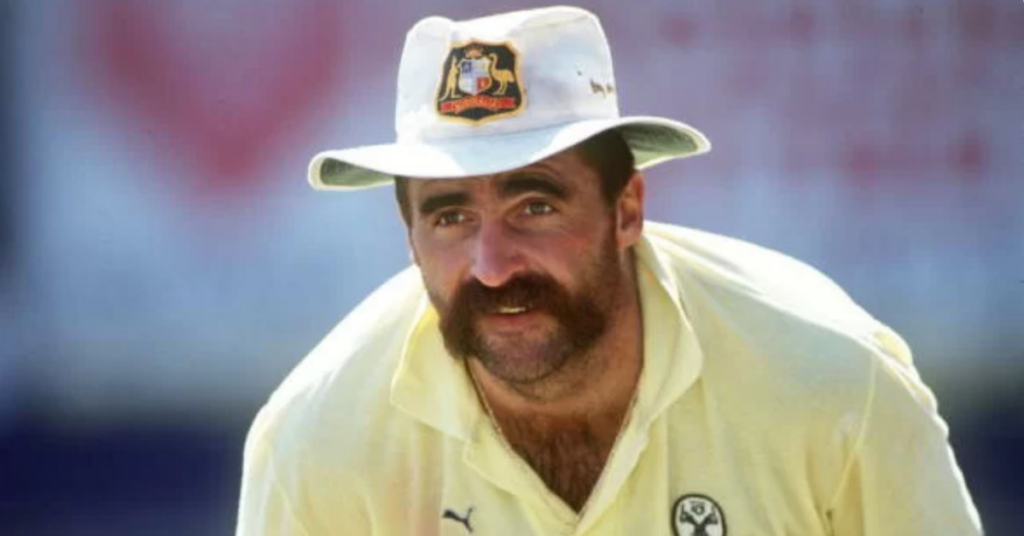

Australian Cricket player Merv Hughes insured his moustache for $370,000. At the same time, Winemaker Ilja Gort got an $8 million insurance policy for his nose after learning that a man lost his sense of smell in a car accident.

Kidnapping and Ransom Insurance

A kidnapping and ransom insurance policy protects the insured and their family from huge kidnap ransoms and everything from medical, accommodation, travel, etc. In the event of a kidnapping, ransom, extortion, and other cases like cyber extortion and workplace violence.

Paranormal Insurance

If you fear spooky events or were an 80’s kid who grew up in Nigeria, you would have heard about the famous “Willie Willie” ghost from a Nigerian horror. A paranormal insurance policy is one of many strange insurance policies, also known as a Spooksafe Insurance cover, protects you from Alien, Ghost, Vampire and Werewolf attacks.

The policy features a hybrid of disability and life insurance policy; it is designed for individuals who are scared about paranormal activity and take folklore stories to heart. Deaths, injuries and any damages by paranormal activity are covered under this type of weird policy insurance policy.

It’s reported that Lloyds of London claim to have around 20,000 insurance policies covering UFO or alien abduction.

Wedding Insurance

For partners who think a cancellation at the last minute might occur or other mishaps that lead to financial loss could appear on the wedding day, the policy covers investment before the knot is tied. The most common Wedding Insurance includes:

Cancellation Cover: protects the insured from issues arising from a wedding postponement or outright cancellation of the wedding.

Liability Cover: takes care of liability arising from the like bodily injury, damage and incidents from any alcohol-related incidents.

Read: Joint Life Insurance; What You Need to Know Before Buying One

Death By Laughter Insurance

I know the Nigerian in you will say “God forbid”, but imagine your favourite Nigerian comedian, on stage cracking jokes, and someone in the audience dies from laughing at his jokes problem.

Although death by laughter may be a rare occurrence, in a reported case in the 1970s, a man named Alex Mitchell died laughing after a half-hour of uncontrollable laughter (leading to heart failure) while watching the comedy show The Goodies.

Death by laughter insurance protects comedians like him from such events.

Multiple Birth Insurance

Having a baby can be a cost burden to families, but when twins, triplets or more, you might seek insurance coverage to lighten the financial load of such. This is where multiple birth insurance comes in, a policy to mitigate the financial burden multiple births create.

In the UK, premiums for this bizarre insurance policy go-between £30 and £400. In a report, British online newspaper The Independent UK called it “a comfort blanket to cling to in case you’re carrying twins”.

In conclusion, whatever opinion you hold about these strange insurance policies, the underlying truth is that it is meant to protect the insured from financial loss. That is why we believe insurance is must-have.